Goodbye 28%, Hello Middle Class Happiness (Terms & Conditions Apply)

It’s that time of year again. Firecrackers are bursting, sweets are flying off the shelves, and politicians are handing out economic reforms like free Diwali mithai. But this time, the Government of India decided to go big—not with ladoos, but with GST rate cuts. And just like that, 28% vanished into the air like a burnt rocket, replaced by what’s being marketed as the savior of the struggling middle class.

The slogan might as well be:

“Buy more, cry less — taxes are now blessed!”

Welcome to the Next-Gen GST Reforms—where prices fall, but optimism rises (until the next fuel hike).

🎉 The Festival of (Tax) Lights

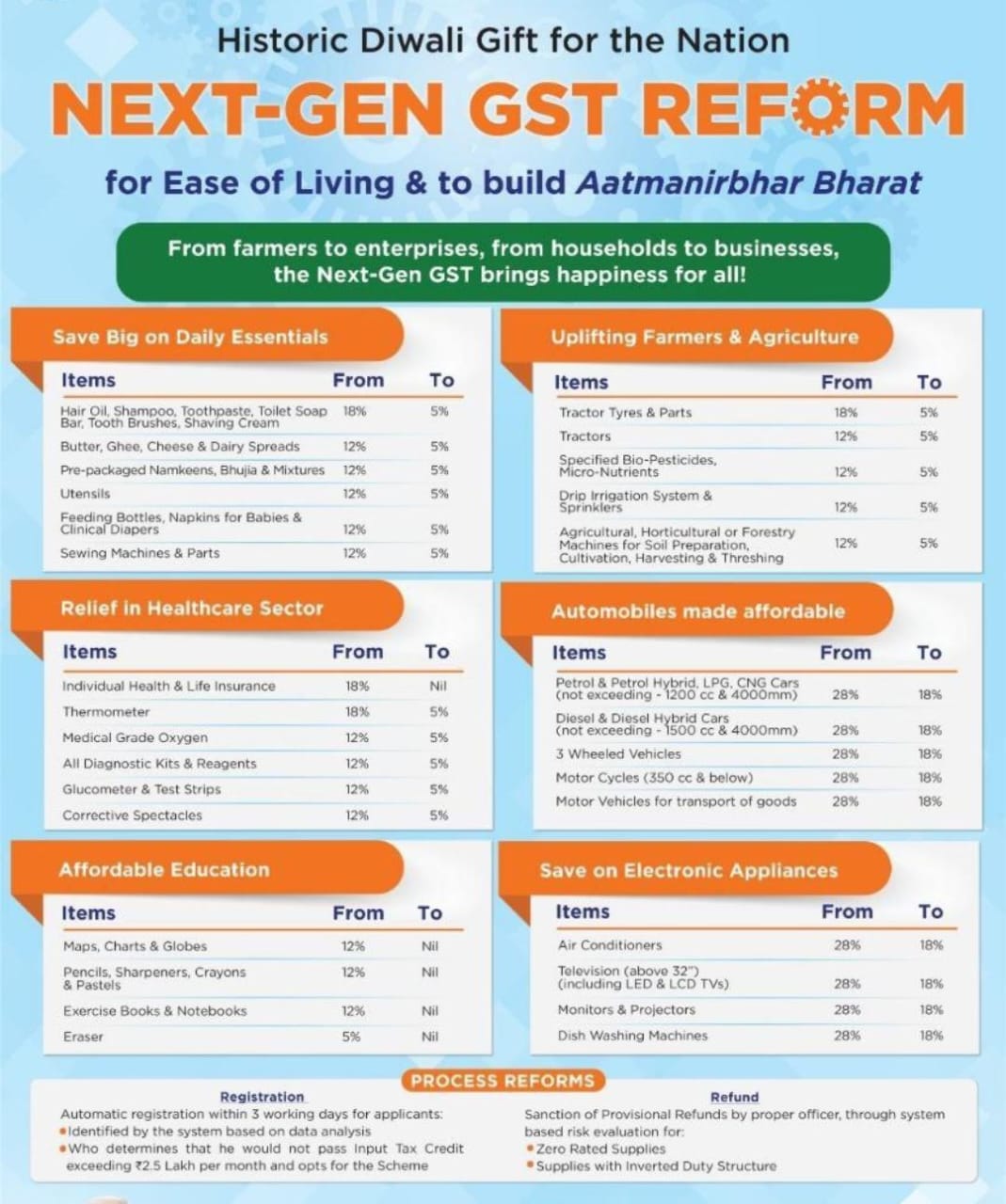

The timing couldn’t have been more perfect. Right before Diwali, the government announced sweeping GST reductions across a wide range of items: daily essentials, farming equipment, healthcare products, educational supplies, and even… wait for it… dishwashers. Because nothing says “middle class upliftment” like reduced taxes on appliances half of us still can’t afford.

It’s a celebration of Indian budgeting – that ancient art of stretching ₹1000 across 10 days, 12 items, and 3 unexpected relatives.

Now, thanks to the GST reform, hair oil, butter, and dishwashing machines are all more affordable—though not necessarily in the same household.

📉 Hair Oil and Happiness – A Correlation?

Among the headliners of this tax reform drama:

-

Hair oil, toothpaste, shampoo: Slashed from 18% to 10% GST. Finally, relief for every Indian mom who buys shampoo in industrial-size packs and believes in oiling away life’s problems.

-

Butter, cheese, dairy spreads: Down from 12% to 5%. The middle class can now afford to spread happiness – literally.

-

Napkins for babies and ladies: 12% to 5%. A sanitary decision. Period.

It’s almost poetic. In a country where we argue about the price of onions like stockbrokers, this is nothing short of a national mood-lifter. Somewhere in a WhatsApp group, an uncle is already typing:

“Modiji ne phir se kar dikhaya!”

🚜 Farmers, Fertilizers, and Freedom

Not to be left behind, the agricultural sector also received a sprinkle of Diwali magic:

-

Tractor parts, bio-pesticides, and harvesting equipment are all down from 18% to 5%-12%.

The next time you see a tractor gleaming in the village sunset, know that behind that sheen lies a slightly less taxed invoice.

Will this be enough to revive the farm sector? Unclear. But it’s definitely enough to revive a few WhatsApp forwards on how India is feeding the world and paying less tax while doing it.

🩺 Healthcare Gets a Healthy Cut

Now this is where it gets serious—well, as serious as satire can be.

-

Thermometers, oxygen, diagnostic kits, and spectacles all got rate cuts from 12–18% down to 5%.

Because nothing says “universal healthcare” like cheaper test strips. At this rate, getting sick might still cost you a fortune—but checking if you’re sick is now way more affordable.

And corrective spectacles at 5%? Perfect. Now the middle class can see their tax savings more clearly.

📚 Education – Class Without Tax

In a dramatic plot twist, stationery items like maps, globes, crayons, pencils, and notebooks will now enjoy zero tax. That’s right, 0% GST.

Finally, India is doing what it always says it will — making education affordable. The 6-year-old with a crayon is now officially living in a zero-tax bracket.

Of course, college tuition, coaching fees, and student loans are still through the roof, but at least the eraser is free from tax guilt.

🛻 Automobiles – Now Just Mildly Out of Reach

Hold on to your car keys—or at least the dream of having some.

-

Electric vehicles: From 12% to 5%

-

Hybrid LPG/CNG cars: From 28% to 18%

-

Vehicle parts: Also down from 28% to 18%

A noble push for green mobility, but remember: while tax may have dropped, on-road prices are still stuck in second gear, with insurance, road tax, and “dealer handling charges” waiting to ambush your wallet.

Still, if you’re already rich enough to buy a car, you’re now just a little less poor.

📺 Electronics – Air Conditioned Dreams

Now let’s talk middle-class dreams: air conditioners, TVs (up to 32”), monitors, dishwashers – all down from a whopping 28% to a more “palatable” 18%.

Critics may argue: “Why cut taxes on luxuries?” But the truth is, nothing is a luxury anymore. In Indian summers, an AC is not indulgence – it’s survival.

Dishwashers too have joined the middle-class wish list, somewhere between “weekend getaway” and “owning a balcony”. With 10% less tax, they’re now only slightly less unaffordable.

⚙️ The Fine Print (a.k.a. Terms & Conditions)

Now, before you start throwing a party in honor of your extra ₹10 savings on shampoo, here are some things to remember:

-

These are rate cuts, not price controls. Whether brands pass the benefit on to you is a different story altogether.

-

Not all categories saw cuts. Luxury items, alcohol, and fuel remain in their taxy thrones, laughing at your optimism.

-

The “middle class” is still a vague term. If you can’t afford the item, the tax cut doesn’t help much. As they say, “You must first have the cart before you celebrate the discount on its wheels.”

-

And of course, inflation might sneak in quietly and undo it all—like that one uncle who comes to every party uninvited.

🧾 The Real Impact: Emotion Over Economy?

Let’s face it: This is more emotional economics than fiscal policy. It’s about the message: “We see you, middle class. Here’s a little less tax. Happy now?”

It’s like the government walked into a Big Bazaar, announced a 50% off sale, and said, “Bhaiya, sabka bill kam kar do.”

And you know what? It works. Perception is policy in today’s world.

-

A homemaker feels seen.

-

A farmer feels supported.

-

A student feels smarter.

-

An office worker feels like maybe—just maybe—his next TV won’t require an EMI plan longer than his college degree.

📣 Final Words: A Middle-Class Memoir

So here we are, in the glow of festive lights and reduced GST slabs, sipping affordable tea (hopefully also with reduced GST), and scrolling through online sales with a little more hope than usual.

Goodbye, 28%. Hello, middle class happiness.

Just don’t forget the asterisk:

(Happiness subject to market prices, corporate generosity, and ongoing government policies. Please read terms & conditions carefully.)